“Which is the smarter option: a card loan or a credit card?”

“What’s the difference between cash advances and loans?”

To clear up these common questions, this article provides a thorough comparison between the two. We’ll cover interest rates, screening, repayment methods, and tips on when to use each, so even beginners can understand and find the best option for their needs. By the end, you’ll know exactly which service fits you best. We hope this helps you use money wisely and plan your finances smartly.

Understand the Fundamental Difference: Card Loans vs. Credit Cards

First, let’s look at the fundamental difference between a “Card Loan” and a “Credit Card”. Simply put, they differ in their primary purpose.

Card Loan: A service specialized in “borrowing money.”

Credit Card: Mainly for “shopping and post-payment,” with an additional function for borrowing cash (cash advance).

To fully understand this difference, let’s first dig into the meaning of the words “Loan” and “Credit.”

What’s the Difference Between “Loan” and “Credit”?

We often use the terms “Loan” and “Credit” casually, but knowing their origins and mechanisms makes the distinction clearer.

🔷 Loan: A Contract to Borrow and Lend Money Directly

“Loan” refers to money that is lent and borrowed directly. For example, home loans, car loans, and card loans all fall into this category. With a card loan, the borrower receives cash directly (via ATM, bank transfer, etc.) and must repay it later.

🔷 Credit: Post-Payment Based on Trust

“Credit” means trust. When we pay with a credit card, the card company temporarily covers the payment to the store on our behalf, based on our “creditworthiness.” Later, we pay back the card company. This is the essence of credit.

In short, a loan is a direct transaction between “Financial Institution ⇔ Borrower”, while credit (shopping) is a three-way transaction between “Merchant ⇔ Card Company ⇔ User.”

Card Loans: The Expert for Borrowing Only

As explained, card loans are a specialized service for borrowing cash.

🔷 Main Purpose: Borrowing Cash

Cards issued for card loans cannot be used for shopping. Their sole purpose is to withdraw cash at ATMs or through bank transfers.

🔷 Providers: Banks, Consumer Finance Companies

Card loans are offered by banks (e.g., MUFG, Mizuho), consumer finance companies (Aiful, Promise, SMBC Mobit), and credit companies (e.g., JCB). Each differs in screening speed, interest rate, and services.

Credit Cards: Shopping First, Cash Advance as Extra

In contrast, credit cards are primarily meant for shopping.

🔷 Main Purpose: Shopping (Post-Payment)

The main feature is post-payment convenience. Benefits such as reward points, travel insurance, and perks are also attached.

🔷 Additional Function: Cash Advance

Some credit cards include a “cash advance limit.” This allows ATM withdrawals, similar to a card loan. However, this is an optional feature, not the main purpose.

🔷 Providers: Credit Companies, Bank-Affiliated Card Issuers

Main issuers include Rakuten Card, JCB, and banks like Sumitomo Mitsui Card and Mitsubishi UFJ Nicos.

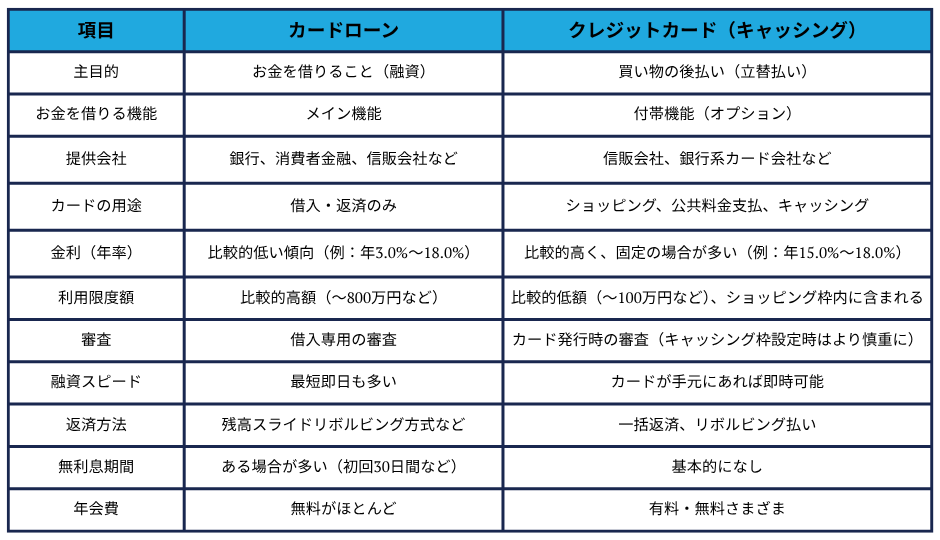

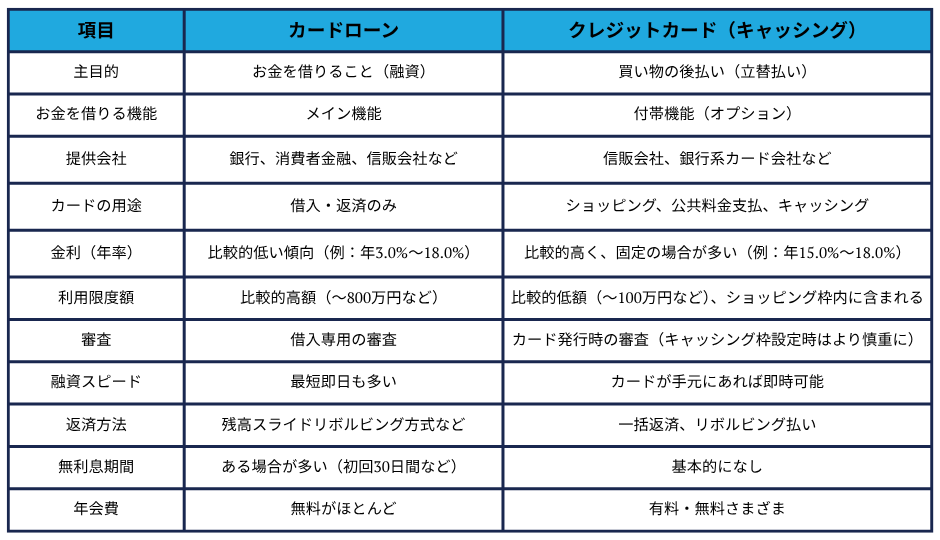

Comparison Table: Card Loans vs. Credit Card Cash Advances

Here’s a simple comparison chart showing the key differences at a glance.

Which to Choose? Pros and Cons

Now let’s answer the most important question: “Which is better when you need to borrow money?”

Pros of Card Loans

Card loans shine when you need a larger amount under favorable terms.

🔷 Advantage 1: Lower Interest Rates

Card loans generally have lower interest rates compared to credit card cash advances. Many adopt tiered interest rates, so larger loans often mean lower interest.

🔷 Advantage 2: Higher Borrowing Limits

Limits can reach up to ¥8M–¥10M for bank card loans, making them suitable for major expenses like home renovations or education.

🔷 Advantage 3: Interest-Free Campaigns

Some lenders offer “30 days interest-free” promotions for first-time borrowers—something cash advances rarely provide.

🔷 Advantage 4: Easier Management

Since card loans are separate from shopping transactions, repayment is clearer and easier to track.

Cons of Card Loans

However, they have some drawbacks compared to credit cards.

🔷 Disadvantage 1: Application & Screening Required

Unlike cash advances on an existing card, card loans require a new application and screening process.

🔷 Disadvantage 2: Cannot Be Used for Shopping

They are strictly for borrowing cash—not for in-store or online purchases.

🔷 Disadvantage 3: Risk of Over-Borrowing

Since ATMs allow easy withdrawals, users may feel like they are using their own money, which can lead to excessive borrowing.

Pros of Credit Card Cash Advances

Credit card cash advances are handy for small, urgent expenses.

🔷 Advantage 1: Convenience—Borrow Instantly with Your Card

If your card already has a cash advance limit, no new application or screening is needed. You can withdraw money immediately from ATMs nationwide.

🔷 Advantage 2: Access to Local Currency Abroad

When traveling, you can withdraw local currency directly from ATMs overseas, avoiding the hassle or high cost of money exchange.

🔷 Advantage 3: One Card for Both Shopping and Cash

Since shopping and cash advances can be managed on a single card, you don’t need to carry multiple cards.

Cons of Credit Card Cash Advances

However, this convenience comes with financial drawbacks.

🔷 Disadvantage 1: Higher Interest Rates

Cash advances usually come with higher interest than card loans—often near 18% annually.

🔷 Disadvantage 2: Lower Borrowing Limits

Typical limits are in the tens of thousands of yen, making them unsuitable for large expenses.

🔷 Disadvantage 3: Reduces Shopping Limit

The total card limit is shared. If you use cash advances, the amount available for shopping decreases accordingly.

Case Studies: Which Should You Choose?

Case 1: Need Over ¥500,000 (e.g., Moving, Tuition)

Conclusion → Card Loan Recommended

Because limits are higher and interest rates lower, card loans are better for large sums.

Case 2: Need ¥50,000 Quickly for a Wedding

Conclusion → Credit Card Cash Advance Recommended

For small, urgent needs, cash advances are faster and more convenient.

Case 3: Short of Cash While Traveling Abroad

Conclusion → Credit Card Cash Advance Recommended

ATMs overseas allow direct withdrawal of local currency, often at better rates than money exchange counters.

Case 4: Consolidating Multiple Loans

Conclusion → Debt Consolidation Loan (a type of Card Loan) Recommended

Card loans for consolidation can reduce interest, simplify repayment into one account, and lower the monthly burden.

Repayment Methods: Installments vs. Revolving

Repayment is as important as borrowing. If misunderstood, interest can snowball.

Card Loan Repayment

Most card loans use the balance-slide repayment system, where monthly payments adjust based on remaining balance.

Extra repayments (prepayments) are highly effective to reduce interest and shorten repayment period.

Credit Card Cash Advance Repayment

Repayment is usually one-time payment (next billing date) or revolving payment.

Revolving Payment Trap: Monthly payments look small, but most of it goes to interest, making it hard to reduce the principal.

Conclusion: Plan Wisely and Choose the Right Service

In summary, card loans are specialists for “borrowing,” while credit cards focus on “shopping,” with cash advances as an optional function.

Neither is inherently better—it depends on your situation. Use the right tool for the right purpose.

Card Loans Suit You If:

- You want to borrow a large amount at lower interest

- You want to benefit from no-interest campaigns

- You prefer clear separation of daily spending and borrowing

Credit Card Cash Advances Suit You If:

- You only need to borrow a small amount instantly

- You might need cash while abroad

- You don’t want to carry multiple cards

Always ask yourself: “Do I really need to borrow now? Can I repay comfortably?” Borrowing relies on your trust and responsibility. Plan carefully, choose wisely, and manage money smartly.