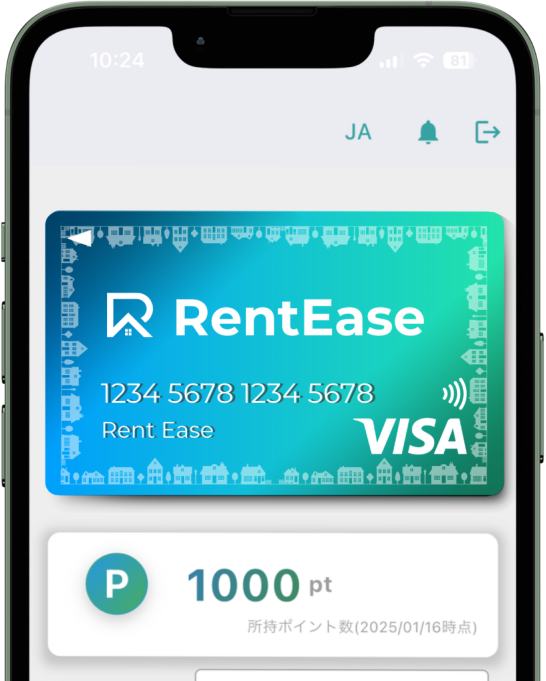

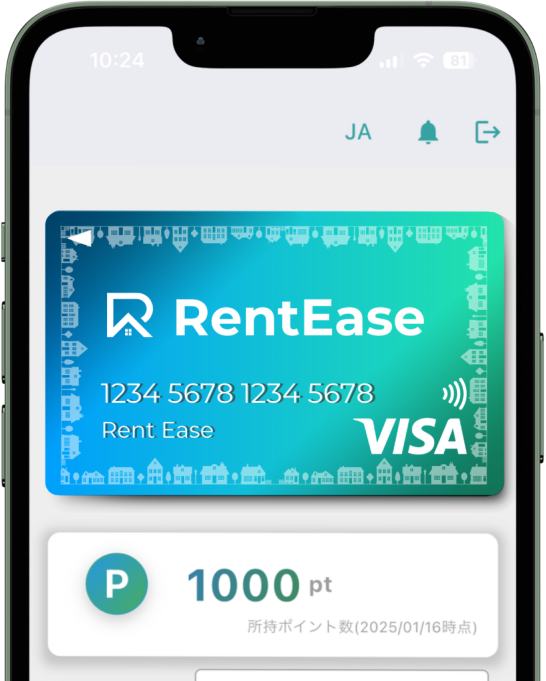

Pay your rent and initial costs

with your credit card by app.

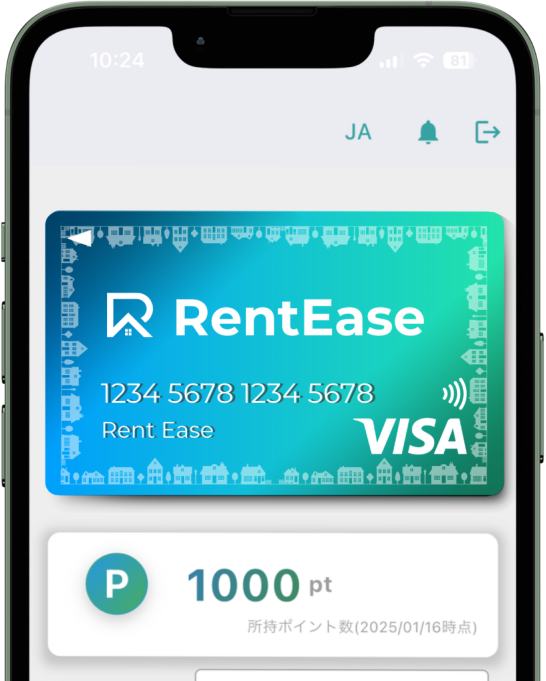

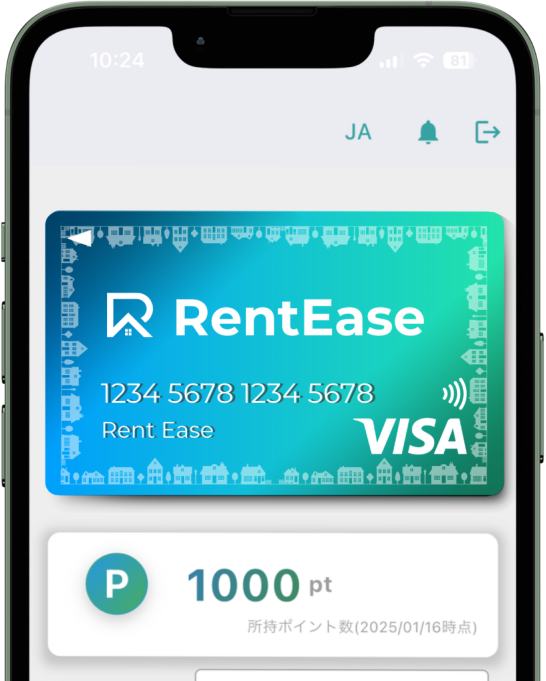

With your card

Easy to start

Initial cost

Monthly fee

Download now!

QRコードをスキャンして、

アプリストアからアプリをダウンロードしてください。

QRコードをスキャンして、

アプリストアからアプリをダウンロードしてください。

RentEase is an official sponsor of the Fukuoka SoftBank Hawks.

© SoftBank HAWKS

RentEase is an app that allows you to pay your rent,

rental fees, initial fees, etc. with your credit card.

Use your existing credit card

Available for both individuals and businesses

Compatible with apartments, offices, warehouses, and more

No setup or monthly

fees—use only when you need it

Earn credit card points

and miles more easily

Earn RentEase points that can be used to pay rent or other expenses.

RentEase does not require a special credit card, you can use your regular credit card. We accept VISA, Mastercard, JCB, American, and Express. You can also use cards issued overseas.

Not only individuals but also corporations can use the app to pay rent, initial fees, renewal fees, etc. Payments can also be made by people other than the leaseholder, so even someone other than the representative can use it to pay rent for a room rented by a family member or a company office.

*However, the person registering the app and the name on the credit card must be the same.

Individuals

Corporations

RentEase supports a wide range of properties, from apartments to offices, stores, warehouses, and factories that are under current lease agreements. It also accommodates properties with rent amounts up to 5 million yen.

With no monthly fees, you can register and use the service only when needed. For example, you could say,

"My expenses are high this month, so I'll pay my rent with a credit card and postpone the withdrawal date."

In addition to overdue rent, with the consent of the management company or landlord, you can also pay multiple months' rent in one lump sum by credit card. Since you are paying a lump sum, it is also an opportunity to efficiently earn points on your credit card.

Switching your rent payments to a credit card boosts your annual spending, helping you earn even more credit card points!

Plus, you'll simultaneously accumulate RentEase points through the RentEase app, maximizing your rewards.

By using RentEase and changing your monthly rent payments to credit card payments, you can efficiently accumulate credit card points. What's more, as your annual usage increases, you'll have more opportunities to receive various benefits!

【Main Benefits of Increased Annual Spending】

01

Upgrade to Higher Membership Status

As your annual spending increases, you may be able to upgrade to higher statuses such as Gold or Platinum.

02

Earn Bonus Points

Additional points are awarded based on your annual spending, helping you accumulate points more effectively.

03

Higher Reward Rates

Upgrading your membership status or increasing annual spending may result in higher reward rates than usual.

Hotel-affiliated or airline-focused credit cards offer even greater benefits. Examples include free hotel stays, business class upgrades, and exclusive privileges at luxury hotels. Transform your daily rent payments into extraordinary experiences with RentEase!

Why not make your rent payments a special part of your lifestyle with RentEase?

Make the Most of Your Credit Card

with RentEase!

RentEase - Pay Rent with Your Credit Card

※ For details on the point redemption rate and breakdown, please refer to the FAQ.

RentEase

Virtual Prepaid Cards

With RentEase, there are no initial or monthly fees. Start paying your rent with a credit card easily, with a simple pay-as-you-go pricing model.

There are no costs to register or start using the app.

No monthly fees, only use it when you need it.

A service usage fee of 5.5% of the rent (tax included) applies when using a credit card for payments.

Search for "RentEase" on the App Store or Google Play and download the app.

Enter the applicant’s information, complete identity verification, and create your account.

Take a photo of your ID and a selfie in the app to perform identity verification.

Once the payment is successful, your credit card will be registered and the process will be complete.

News

Latest News

2026.01.27

2025.12.03

2025.10.31

2025.10.28

2025.10.21

2025.09.19

2025.09.24

「キャッシュレスを始めたいけど、クレジットカードは使いすぎが心配…」「高校生でも持てるカードってあるのかな?」「デビットカードってよく聞くけど、一体どんなカードなの?」 現金を持た...

Read Article

2025.09.10

「このクレジットカードのマーク、どんな意味があるんだろう?」「お店のレジにあるマークの種類が多くて、自分のカードが使えるか分からない…」「最近よく見る電波みたいなマークって何?」 ...

Read Article

2025.08.07

Finally, your long-awaited overseas trip. Beautiful scenery, delicious food, exciting shop...

Read ArticleYou can search for 'RentEase' in the App Store or Google Play Store and download it for free. You can also download it directly from the 'App Store' and 'Google Play' icons on this site.

The app is free to download, register, and use. However, a 5.5% fee (tax included) is charged per payment.

You will need your name, email, phone number, property information, and credit card details. You will also need to provide identification and your rental agreement.

Yes, it is possible. Offices, stores under corporate contracts, and residences contracted by family members are also supported. However, the applicant and the credit card holder must be the same person.

Residences, offices, shops, warehouses, and factories are supported, up to a monthly rent of 5 million yen.

The first payment is on the day you register your credit card. From the following month onward, payments are processed on the 15th. The date cannot be changed.

Yes, as long as you complete registration and card payment by 9:00 AM between the 1st and 14th of the current month.

Yes, you can. For example, you may switch only this month's rent to credit card payment or use it for initial fees or renewal fees.

The withdrawal date follows your card issuer's schedule, not the day RentEase processes the payment. In most cases, this is the next or the following month.

Transfers are made on the 25th of each month (or the next business day if it falls on a holiday).

No, the transfer date is fixed to the 25th of each month (or the next business day if it falls on a holiday).

The transfer appears under the name you registered during the procedure.

Yes. You need to obtain consent from your landlord or management company before using RentEase.

Download the RentEase App now!