With rising living costs, many couples are now rethinking their household finances. Marriage or moving in together is often the moment when couples start taking financial management seriously. It’s only natural to set goals such as “We want to manage our household budget together” or “We want to save more efficiently.”

Did you know that a credit card can be a powerful tool for household management? Beyond being just a means of payment, when used effectively it enables “visualization of expenses”, helps you accumulate points to save money, and makes everyday payments smarter—a true “credit card lifestyle.”

However, you may also wonder: “Which card should we choose?”, “How do we share card information as a couple?”, or “What exactly is a family card?” Some may even feel uncertain about going cashless.

This article will walk you through how to make the most of credit cards for household management—from the basics of choosing the right card to specific management techniques. By the end, you’ll be able to design a credit card strategy that fits your lifestyle and values, taking the first step toward a richer, stress-free household budget.

“Credit Card Strategy for Couples” – Benefits for Household Management

While Japan is rapidly moving toward a cashless society, some people may still feel that “cash is safer” or worry about overspending with cards. But when couples consciously use credit cards, the benefits far outweigh these concerns. Let’s look at why couples should consider a credit card strategy together.

“Visualization” of Expenses and Easier Management

The key to household management as a couple is accurately understanding “how much money is being spent on what.” Paying with cash is convenient, but unless you keep receipts and track them, it’s difficult to see the bigger picture. Before you know it, you may end up saying “We’re in the red again this month.” By using credit cards as your main payment method, this issue can be greatly improved.

〈Clear at a Glance with Statements〉

Monthly statements automatically record “when,” “where,” and “how much” was spent, allowing you to easily and accurately track household spending.

〈Easy Reviews〉

At the end or beginning of the month, couples can sit down with the statements to discuss things like “We overspent on food this month” or “Let’s cut back on this expense next month.” This makes it easier to review finances based on objective data—something difficult with cash payments.

By “visualizing” expenses in this way, couples can share financial awareness smoothly. Instead of relying on vague memories, both partners look at the same data, making it easier to align values—what to prioritize, where to cut back—and avoid misunderstandings, mismatched expectations, or frustration. With greater transparency comes stronger trust and smoother cooperative household management.

Earn Points Efficiently and Save More

One of the biggest advantages of using credit cards is reward points. Unlike cash, points accumulate with spending, and when couples work together, they can maximize efficiency and savings.

〈Point Consolidation〉

By consolidating daily shopping, utilities, communication bills, insurance, rent, and other major expenses into a single credit card, couples can accumulate points much more efficiently.

〈Diverse Redemption Options〉

Collected points can be redeemed for cash back, airline miles, travel expenses, gift certificates, merchandise, or even applied directly to credit card bills. For example, you could cover part of a family trip with points earned over the year or buy that appliance you’ve been eyeing at a discount. Popular programs offer a variety of redemption choices, making point usage a practical form of savings.

In this way, maximizing points transforms daily expenses from mere “consumption” into “value creation.” After all, if you have to spend on living expenses anyway, wouldn’t you want to do it in the most rewarding way? Treating points like a game can make budgeting more enjoyable and reduce the negative image of “saving equals sacrifice.”

Cashless and Smart Payments (“Credit Card Lifestyle”)

Cashless payments are spreading rapidly in Japan, and a “credit card lifestyle” makes daily spending smarter and more comfortable.

〈Faster Transactions〉

No more fumbling with coins at the register. Payments are completed quickly with a signature, PIN, or contactless tap. For busy couples balancing work and home, these small time savings add up to a major advantage.

〈Reduced Cash Handling〉

You no longer need to withdraw money from ATMs or worry about carrying large sums of cash, which reduces both effort and the risk of theft. Many cards also include fraud protection, offering more peace of mind than cash.

〈Essential for Online Use〉

Online shopping and subscription services (video streaming, music streaming, etc.) almost always require a credit card. Going cashless is key to enjoying these modern conveniences.

Thus, a “credit card lifestyle” is not just about convenience—it can reshape your entire lifestyle, making everyday life and payments smarter and more comfortable.

How to Choose the Right Credit Card for Couples | 5 Key Checkpoints

After understanding the benefits of using credit cards as a couple, the next important step is deciding which card to choose. With countless options available, each offering different features, it’s crucial to find one that fits your lifestyle and goals. Here are five essential checkpoints to guide couples in selecting the best card.

1. Annual Fees: Free vs. Paid Cards

Credit cards range from those with no annual fee to premium cards that cost tens of thousands of yen per year. Understanding the difference is the first step in making the right choice.

〈No-Annual-Fee Cards〉

No-annual-fee cards are cost-free and easy to hold, making them great as a “starter card” or a sub-card. They generally include basic point programs and some services but may have lower reward rates or limited perks compared to paid cards.

〈Paid Cards〉

Paid cards typically offer higher reward rates, free access to airport lounges, comprehensive travel and shopping insurance, gourmet privileges, and concierge services. Many provide perks worth more than the annual fee itself. However, if you don’t use these benefits, the cost may outweigh the value.

〈How to Decide〉

Consider your annual spending and lifestyle. For example, if you spend over ¥1,000,000 per year on your card, travel several times annually, or value airport lounges, a paid card may provide excellent value. On the other hand, if your usage is low, starting with a free card might be the smarter choice.

2. Reward Rates and Ease of Earning Points

To maximize point accumulation, it’s important to consider not only the base reward rate but also how easy it is to earn bonus points.

〈Base Reward Rate〉

This refers to the percentage of points earned per purchase. Most cards offer around 0.5%–1.0%, but some provide 1.2% or higher, making them especially attractive.

〈Bonus Points & Multipliers〉

Some cards offer higher rewards when used at specific stores or services (e.g., partner supermarkets, convenience stores, drugstores, online shops, or for mobile phone bills). This feature can greatly boost your total rewards.

〈Point Malls〉

When shopping online through a card company’s “point mall,” you can earn bonus points in addition to the standard rate, further increasing your rewards.

〈Campaigns〉

New member campaigns or seasonal promotions often provide opportunities to earn large amounts of bonus points. Checking for these before signing up is highly recommended.

〈How to Decide〉

While a high base rate is important, focus more on whether the card earns extra points at stores or services you use frequently. For example, if you often shop at a specific supermarket, drugstore, or online store, choose a card that offers multipliers there. Reviewing your household spending habits is the first step toward finding the most rewarding card.

3. Additional Benefits & Insurance (Travel, Shopping, Lounge Access, etc.)

Beyond points, many credit cards come with a variety of insurance policies and perks. These can be just as valuable when choosing the right card.

〈Travel Insurance〉

Coverage for accidents, illnesses, or lost items during domestic and international trips. Policies may include accidental death and disability, medical expenses, liability, lost luggage, and emergency assistance. The coverage amount and conditions vary by card, so check details carefully (e.g., medical expense limits, eligible incidents).

Some cards offer automatic coverage (just by holding the card), while others require usage-based coverage (you must pay travel expenses with the card). Also confirm whether family members are included under the policy.

〈Shopping Insurance〉

Often called “purchase protection,” this covers accidental damage, theft, or fire loss of items bought with the card, typically within 90 days of purchase. Be aware of exclusions (e.g., food, tickets, animals) and deductibles depending on the card.

〈Airport Lounge Access〉

Free access to domestic and international airport lounges makes travel more comfortable. Whether companions can join for free or at an extra cost depends on the card.

〈Other Privileges〉

Discounts at restaurants and hotels, deals on leisure facilities, and special shopping offers are also common features.

〈How to Decide〉

Choose a card that provides the benefits most useful to your lifestyle. Frequent travelers may prioritize travel insurance and lounge access, while couples making large purchases might prefer robust shopping protection. Always review not only the coverage itself but also conditions and claim procedures.

4. Family Card Availability and Conditions

The family card is a highly convenient option for couples. Issued under the primary cardholder’s credit, it allows spouses, children (18+), or parents to share card benefits.

〈Issuance & Eligibility〉

Not all cards allow family cards. Eligibility criteria (e.g., who qualifies as a family member) differ by issuer.

〈Annual Fee〉

Family cards are usually cheaper than primary cards, and often free.

〈Credit Limit〉

The limit is shared with the primary cardholder. For example, if the limit is ¥1,000,000, combined usage by both cannot exceed that amount.

〈Points〉

Points earned on family cards are usually combined with the primary cardholder’s account, making accumulation faster and easier.

〈How to Decide〉

If your goal is to consolidate expenses and maximize point accumulation, check if the card issuer offers family cards and review conditions such as fees and eligible family members.

5. Payment Account Setup

Don’t forget to consider how payments are withdrawn from your bank account when using credit cards as a couple.

〈Shared Account Withdrawal〉

Option 1: Each spouse holds their own primary card, but both link them to a shared bank account for withdrawals.

Option 2: One spouse holds the primary card while the other holds a family card. Combined usage is withdrawn from the primary holder’s account (or joint account if available).

〈Important Notes〉

Some banks restrict which account names can be used for card withdrawals. In Japan, true joint accounts are limited, so in practice, many couples designate one spouse’s account as the “shared account.”

〈How to Decide〉

If you want to unify household finances, confirm whether your card and bank support shared or joint accounts. This setup simplifies management, ensuring all spending is withdrawn from one account and making household budgeting much easier.

Family Cards Explained in Depth

When it comes to smart credit card use for couples, the family card (also called supplementary or additional card) is one of the most valuable tools. It can simplify household budgeting and accelerate point accumulation. Let’s break down how family cards work, their pros and cons, and how to apply for them.

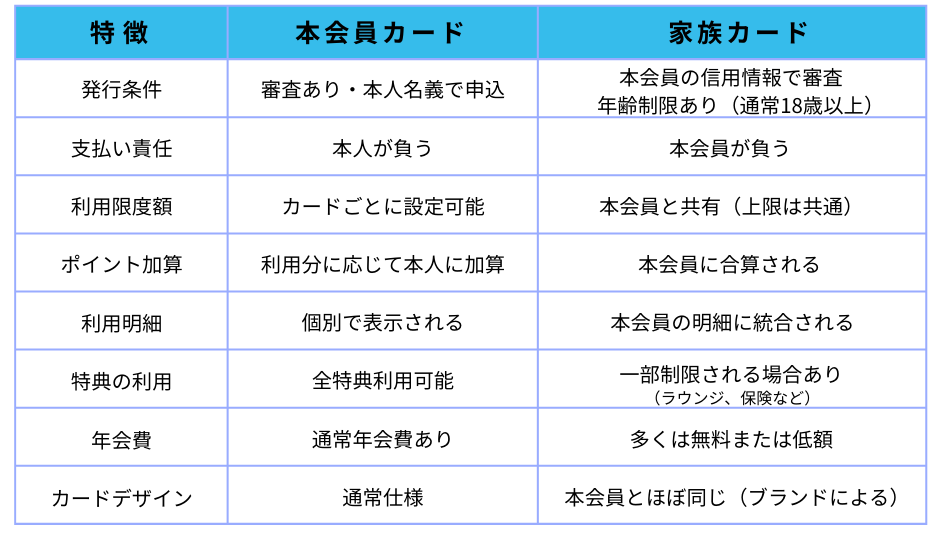

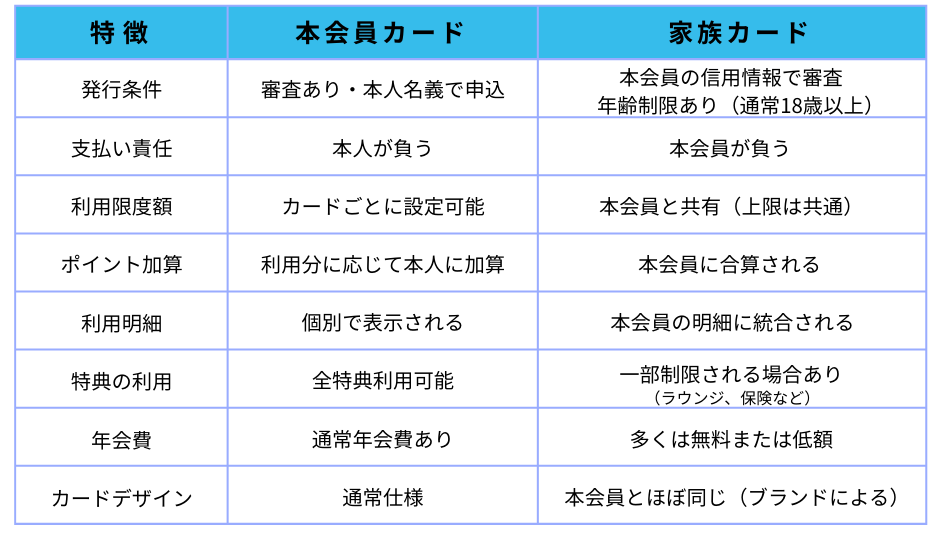

What Is a Family Card? Differences from a Primary Card

A family card is an additional card issued under the credit standing of the primary cardholder. Unlike a completely separate card contract, it shares the same account and credit limit as the primary card. Key differences include:

Approval for a family card is based on the primary cardholder’s credit history. The family member’s income or credit score usually does not matter (though age or relationship conditions may apply). Payments are charged to the primary holder’s registered bank account, and the repayment responsibility lies with the primary cardholder. The total spending limit is shared—for example, if the limit is ¥1,000,000, the combined usage by both primary and family members cannot exceed that amount. Family cards often have the same design and basic functions as the primary card, but some premium perks (e.g., certain insurances or lounge access) may be exclusive to the primary cardholder.

Benefits of a Family Card

Family cards provide a number of advantages for couples and households aiming to streamline financial management.

1. Simplified Household Management

Since all family card spending appears on the primary cardholder’s statement, couples can instantly see total household expenses in one place. This transparency reduces the need for manual bookkeeping and lowers the risk of missed payments.

2. Faster Point Accumulation

Points earned on family cards are automatically combined with the primary cardholder’s points, making accumulation more efficient and helping couples reach reward goals—like travel miles or gift redemptions—faster.

3. Cost Savings

Family cards usually cost less to maintain than issuing two separate primary cards. Many are even free, making them an economical way to expand card usage within a household.

4. Partial Sharing of Perks

Some benefits attached to the primary card—such as insurance, lounge access, or partner discounts—may also extend to family cardholders (terms vary by issuer).

5. Easier Approval

Because the application relies on the primary holder’s credit record, family cards are often available to non-working spouses, students (18+), or others without independent income.

Drawbacks & Considerations

Despite their convenience, family cards also carry certain limitations and risks that couples should be aware of.

1. Shared Responsibility & Risk

Since all spending counts against the same limit, it’s possible to hit the cap sooner, especially with large purchases. Overspending can block further use and strain finances. Moreover, the primary holder is fully liable for repayment, meaning late payments affect their credit record. Clear rules and communication are vital.

2. Limited Flexibility & Privacy

Family cards must be the same brand/type as the primary card, so individual preferences are limited. In addition, all usage details are visible on the shared statement, which could cause stress if spouses have different spending habits. Couples should establish clear boundaries and open communication to avoid conflicts.

In short, while family cards can simplify budgeting and maximize rewards, they require mutual trust and transparency. Setting clear household rules (e.g., consulting before large purchases) ensures smoother cooperation.

Household Budgeting with Credit Cards

When used wisely, credit cards can dramatically improve the efficiency of a couple’s household budgeting. For dual-income families or couples raising children, the benefits can be even greater. Here are some practical strategies for managing household finances with credit cards.

Strategy: Split by Purpose vs. Concentrated Use with Family Cards

There are two main strategies for couples using credit cards together.

Strategy 1: Split Cards by Purpose

- How it works: Use different cards for different spending categories—for example, a supermarket card for groceries, an airline card for travel, an e-commerce card for online shopping, and a high-reward card for all other purchases. Couples can divide responsibilities or each hold multiple cards.

- Pros: Maximizes points and benefits in each spending category, allowing for the greatest overall rewards. Ideal for couples who want to optimize every yen spent.

- Cons: Managing multiple cards is more complicated. Tracking which expenses were paid with which card, checking several statements, and handling multiple accounts requires more coordination.

Strategy 2: Concentrated Use with a Family Card

- How it works: Choose one primary card (or one reward program) and use it as much as possible. The main cardholder and the family cardholder both charge their expenses to the same program.

- Pros: All spending is consolidated into one statement, making it simple to review and track. Points accumulate faster in one place, and management is easier.

- Cons: Since not all categories will have the highest rewards, efficiency may be lower compared to splitting cards by purpose.

Which strategy should you choose? It depends on your priorities. If you want maximum efficiency and rewards, go with Strategy 1. If you prefer simplicity and ease of management, Strategy 2 with a family card is recommended.

Make It Easier with Budgeting Apps

By linking credit cards with household budgeting apps like Money Forward ME or Zaim, transaction data is automatically reflected in your budget. This reduces the hassle of manual entry and helps couples maintain better financial visibility.

Advantages of Using Apps

- No need to manage receipts or manual input

- Check spending in real-time

- Automatic categorization (food, daily goods, utilities, etc.)

- Easy budget management and monthly reports

Credit card integration with apps can be a game changer for busy couples. It reduces the workload of budgeting and makes financial management less stressful and more sustainable.

Regularly Reviewing Statements Together

Convenience alone isn’t enough—what matters most is sharing financial information.

Why Sharing Matters

- Helps detect fraudulent activity quickly

- Prevents overspending and makes budgeting adjustments easier

- Builds shared financial goals and understanding

- Encourages natural conversations about money, strengthening the relationship

Tips for Sharing

- Set a fixed day each month to review (e.g., last day of the month)

- Go over statements or app data together

- Frame conversations positively—“What should we use our points for?”

Regularly sharing and discussing household finances not only improves transparency but also strengthens trust. Combining credit cards with shared accounts and apps makes household budgeting both efficient and cooperative.

Summary: Enrich Your Household Budget with the Right Credit Card Choice

Smart use of credit cards as a couple is more than just a change in payment method. It can streamline budgeting, make daily life more rewarding, and even improve communication between partners.

As we’ve seen throughout this article, credit cards offer the following advantages:

- Visualization of spending

- Maximizing point rewards

- Convenience of cashless payments

And when choosing the right card, couples should carefully discuss and check these five key points:

- Annual fees

- Reward rate and ease of earning points

- Insurance and perks

- Family card availability

- Withdrawal account settings

By understanding how family cards work, integrating with budgeting apps, and regularly sharing information, couples can maximize the benefits of credit cards for household management.

Discussing “which card to use and how” as a couple will not only improve your household finances but also strengthen your partnership. Start by reviewing the cards you already have or explore new options together. With the right credit card strategy, you can enrich your household budget and build a brighter financial future.