As cashless payments become deeply embedded in our lives, more and more people want to pay their monthly rent—a major recurring expense—by credit card.

However, as of 2025, bank transfers and automatic account withdrawals are still the most common methods, and credit card payments are not yet widespread.

In this article, we will explain the current situation of paying rent with a credit card, the advantages and disadvantages, specific methods, how to find properties that support it, and negotiation tips for implementation—so you can use it wisely.

From the perspective of convenience and reward points, the demand for paying rent with credit cards is expected to continue increasing.

The Latest Trends in Paying Rent by Credit Card in Japan

Adoption Rate and Demand

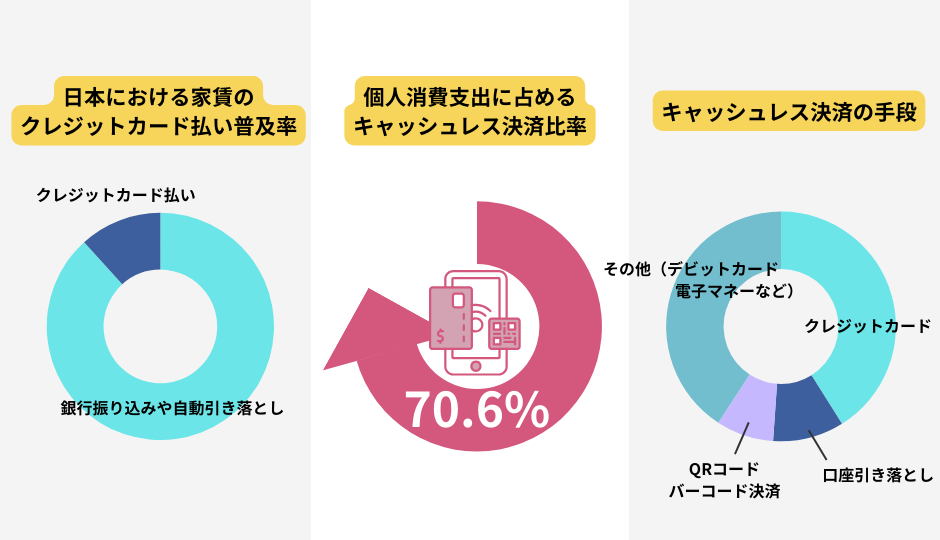

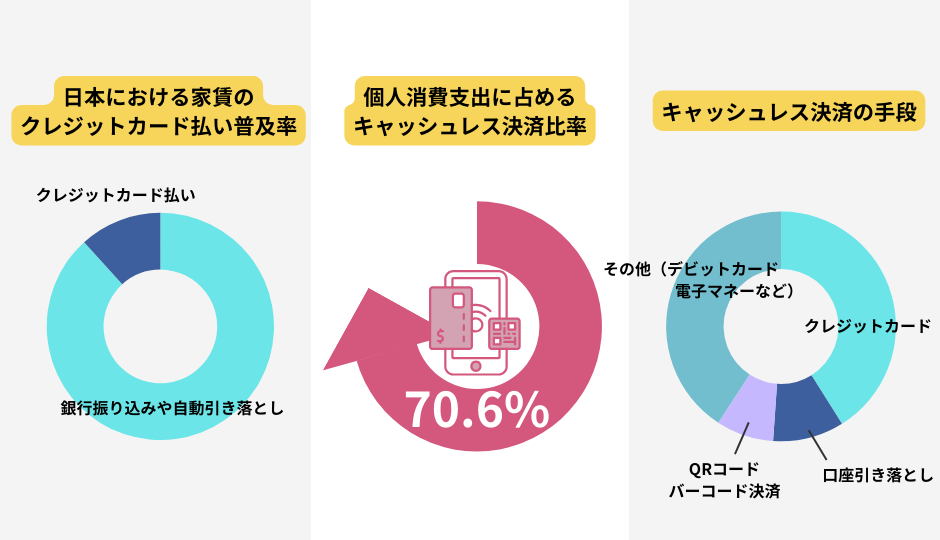

The adoption rate of rent payments by credit card in Japan is still limited, though gradually increasing. Even so, bank transfers and automatic account withdrawals remain the norm, and credit card usage for rent is not yet common.

According to a 2018 study by the National Institute for Research Advancement (NIRA), only 11.7% of people chose to pay their rent by credit card. Other surveys also showed rates below 10%, which is low compared to the overall credit card ownership rate (86–87%). This indicates that applying credit cards to rent payments has not progressed much.

While credit card use overall has grown rapidly, rent payments remain around 10% usage. For example, NIRA’s 2023 study reported that cashless payments accounted for 70.6% of household consumption, with credit cards at 41.1%, the largest share. JCB’s survey also showed that by value, credit cards accounted for over 80%, and by transaction count, about 52%—showing their suitability for large recurring expenses like rent.

Thus, while there is still a gap between general credit card usage and rent payments, it is an area expected to see growth in the future.

Only a Few Properties Support It—for Now

Although paying rent by credit card is attractive for convenience and rewards, only a small fraction of rental properties currently support it. Some major management companies and new services are introducing it, but nationwide adoption remains at around 5–10%, which is still quite limited.

Meanwhile, demand from tenants who want to pay rent by credit card is increasing year by year. In the future, with more standard adoption by large property managers and stronger partnerships with rent guarantee companies and payment processors, availability is expected to expand. Soon, whether a property allows “credit card rent payments” may become a key factor in choosing a place to live.

Why Isn’t Rent Paid by Credit Card More Common?

The biggest reason is transaction fees.

Credit card payments usually involve 3–5% in fees, and sometimes up to 8%. These costs are normally borne by landlords or management companies.

Other barriers include settlement delays from card companies, restrictions that prevent passing fees on to tenants, and traditional management practices by individual landlords.

In some cases, negotiation for credit card rent payments is possible, where a tenant’s request prompts the management or guarantor company to consider adopting it. However, feasibility depends on the property and management system, so careful confirmation is required when negotiating.

How to Pay Rent with a Credit Card

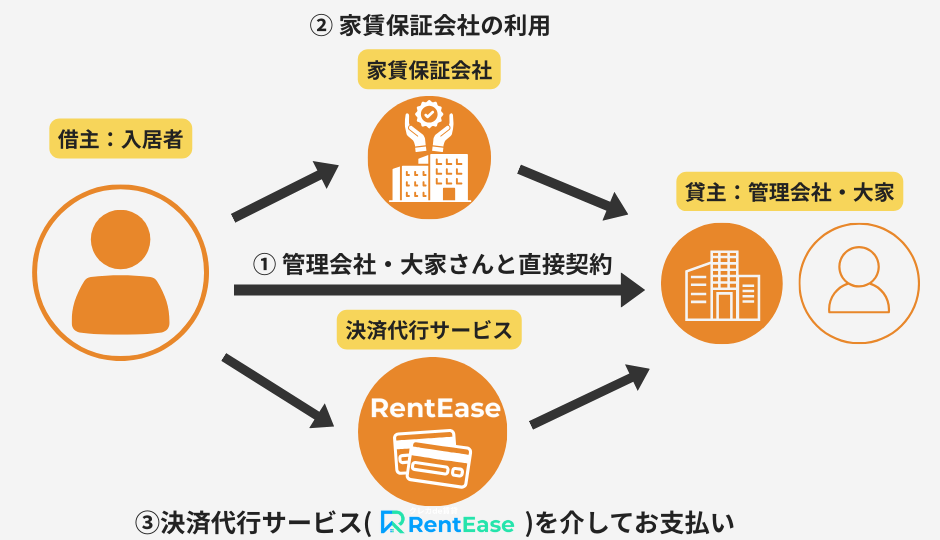

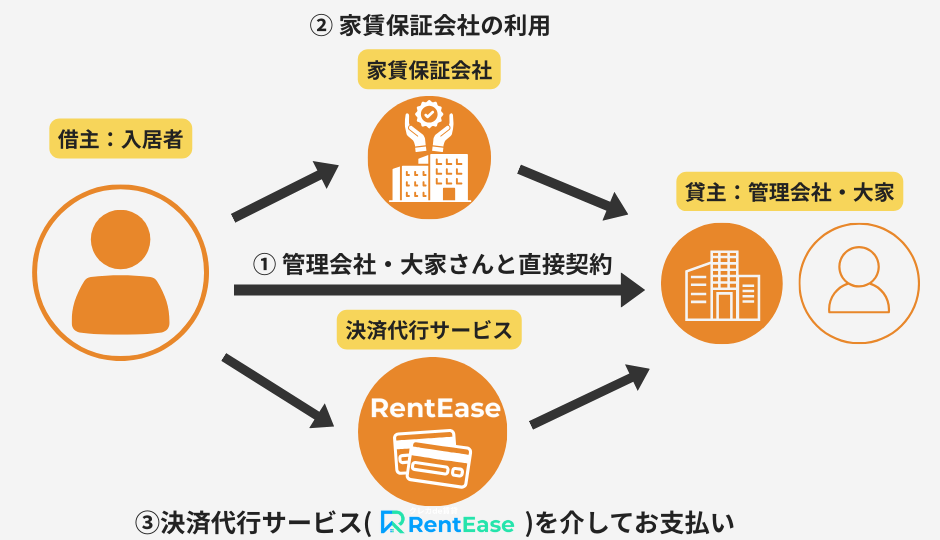

There are three main routes for paying rent with a credit card. Which option is available depends on the property and whether the landlord or management company has adopted it.

① Direct Contract with Management Company or Landlord

Some large management companies have agreements with credit card companies that allow rent to be paid by card. In this case, you simply register your card information through the company’s website or during the lease contract process, and monthly rent is charged automatically.

② Through a Rent Guarantee Company

Some rent guarantee companies, such as EPOS Card’s “ROOM iD” or Saison Card’s services, support credit card payments. Often, specific affiliated cards are required, and the procedure is completed at the time of contract.

③ Through a Payment Processing Service

With a third-party payment processor such as RentEase, you can pay rent by credit card even if your landlord or management company does not directly accept it. Tenants pay RentEase by credit card, and RentEase transfers the rent to the landlord or management company.

Advantages of Paying Rent by Credit Card

Earn Points and Miles – A Hidden Advantage

The biggest attraction of paying rent by credit card is earning reward points and miles, which translate into real savings.

For example, paying ¥100,000 rent with a 1% cashback card earns ¥12,000 worth of points annually. If you use a mileage card such as ANA or JAL, you could earn enough for one or two round-trip domestic flights per year. Over time, this turns rent—a major fixed cost—into a valuable financial benefit.

Tips for Maximizing Rewards:

- Use high-reward cards (Rakuten Card, EPOS Card, Life Card, etc.)

- Take advantage of airline mileage cards (e.g., ANA VISA Wide Gold, JAL Card, Marriott Bonvoy Amex)

- Choose cards that allow points to be used for rent payments

Easier Payment Management

With automatic card payments, rent is processed seamlessly every month—eliminating late payments and bank transfer fees. Linking with household budget apps makes expense tracking easier.

- Unify expenses in your credit card statement

- Prevent missed payments (auto debit)

- Easily review monthly spending for savings planning

Credit Card Status Upgrade

Regularly paying rent by credit card builds a strong credit history. Higher annual usage often results in upgraded membership tiers with more perks.

- EPOS Card: no point expiration, bonus shops, free airport lounge access

- Rakuten Card: higher cashback on Rakuten marketplace, lounge access

- Other examples: Sumitomo Mitsui, Saison, and more offer tier-upgrade benefits

Cautions and Disadvantages of Paying Rent by Credit Card

Risk of Hitting Credit Limit and Insufficient Balance

Rent is usually one of the largest monthly expenses, which means it can quickly use up your credit limit. If your limit is low, everyday purchases and utility bills may be affected. In addition, if your bank balance is insufficient on the payment date, you may be marked late, which could negatively affect your credit history if repeated.

Countermeasures: Request a higher credit limit, dedicate one card solely for rent, or spread other spending across different cards.

Possibility of No Points or Miles

Not all cards award points or miles for rent payments. Some payments via guarantee companies or payment processors may be excluded from reward programs.

Countermeasure: Always check the card issuer’s terms to see if “real estate-related expenses” or “rent payments” are eligible for rewards.

Indirect Cost Burden from Fees

Since management companies must bear processing fees (usually around 3–5%), some card-compatible rental properties may have slightly higher rent compared to non-card properties.

Countermeasure: Compare rent prices between properties that allow card payments and those that don’t, to ensure the rent isn’t set higher than the value of rewards you’d earn.

Tips for Negotiating Credit Card Rent Payments

Even if a property doesn’t currently support card payments, sometimes tenants can request it and prompt the management company to consider implementation.

Key Questions to Ask Management or Real Estate Companies

- Can initial costs (deposit, key money, etc.) also be paid by card, or only monthly rent?

- Which card brands are accepted (Visa, Mastercard, JCB, etc.)?

- Are there any tenant-side fees (normally borne by landlords)?

Negotiation Tips

- Mention your preference during pre-contract discussions (before signing the lease).

- Request that initial costs be payable by credit card.

- Point out the availability of payment processors or third-party services that can facilitate card payments.

How to Find Properties That Accept Rent Payments by Credit Card

Search on Real Estate Portals

Major listing sites like SUUMO, LIFULL HOME’S, and at home allow you to filter properties by “Credit Card Payment Available.”

- Use checkboxes such as “Card Payment” or “Credit Card Accepted.”

- Search with keywords like “rent credit card payment.”

- Check whether credit card usage applies to monthly rent or only initial costs.

Ask Management or Real Estate Companies Directly

If you find a property of interest, ask the agent or management company directly, for example:

- “Does this property support rent payments by credit card?”

- “Is it available for both monthly rent and initial fees?”

- “Which card brands are accepted? Are there any extra fees?”

Conclusion

Rent Payments by Credit Card Can Offer Major Benefits

Paying rent with a credit card can provide significant benefits such as earning points and miles, preventing missed payments, smoothing cash flow, and simplifying expense tracking. However, it also has drawbacks, including limited property availability, potential pressure on credit limits, and possible ineligibility for rewards.

Expect Broader Adoption in the Future

As of 2025, rent payment by credit card is not yet mainstream, but with the rise of cashless payments and more management companies adopting the system, it may soon become a standard option.

Demand is steadily increasing, and “credit card rent payment” is expected to become an increasingly important option. As a provider of rent payment solutions, we aim to contribute to this expansion and lead the way in improving convenience and accessibility for tenants and landlords alike.